Some suggest we may be heading for the golden age of long-term care insurance. I hope so.

In 2002 when I started in this specialized insurance niche the industry reported $1.5 billion in new standalone premiums. A decade later the premiums had dropped to $600 million. Now the latest numbers for 2021 indicate total standalone premiums dropped again to $200 million. And that includes sales in Washington State where the incentive to buy private insurance and avoid a payroll tax was huge.

Tens of thousands bought. But most of those that we helped bought the cheapest policy offered before insurance companies saw what was happening and discontinued sales until after the deadline.

The Washington Cares Act did not stimulate prudent long-term care expense planning. In fact, it was so poorly designed that the implementation has been postponed until mid-2023. Not to mention that the benefit available is woefully inadequate. Lifetime maximum benefit is $36,500. Or, $100 per day for one year.

According to the American Association for Long Term Care Insurance, the 2020 long-term care claim averaged over $137,000. And more than 50% of those on claim needed care for well over a year.

So why would anyone think we might be heading for a golden age? Several reasons.

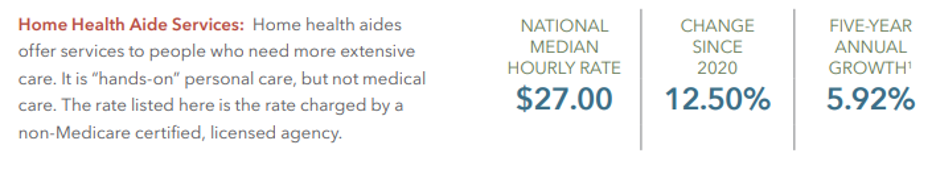

One is the increasing cost of care. If we need care, most of us want to remain in our own homes. According to the annual Cost of Care Survey published by Genworth Financial, the cost of a home health aide increased 12.5% from 2020 to 2021.

It’s the classic economic equation of supply and demand. Home health care companies have been hit with factors that increase their costs. These include minimum wage requirements and COVID related costs for PPE (personal protective equipment), training and procedures.

Every year 10,000 baby boomers are turning 65 and 70% will experience a long-term care event in their remaining years. Demand will continue. As will costs. We already have a shortage of caregivers and care venues.

Yet another reason is that 12 other states are in the process of designing their own state-sponsored programs. Yikes! That’s scary. What do states know about designing long-term care programs? Not much if we look to the fiasco that Washington State wrought on its residents.

States are concerned about Medicaid costs. Medicaid is the government program for long-term care services. And Medicaid is the fastest growing line item on most state budgets.

I’ve often said that only those with private long-term care insurance will be able to afford quality care.

Even a small policy will offset significant cost. We customize every policy based on our clients’ health history, wealth, affordability and financial goals.

Back to the golden age. Now is the time. Get out in front of these state-sponsored projects and do your own long-term care expense planning. You will be glad you did! So will your loved ones.