In his 2019 industry update, Jesse Slome, executive director of the American Association for Long-Term Care Insurance, reported that LTC insurance claims paid in 2018 totaled $10.3 billion.

Insurance pays a fraction of LTC costs

Sounds like a lot, doesn’t it? Well, it’s not. It’s barely a fraction of the estimated costs.

According to a report published by the SCAN Foundation, private long-term care insurance accounted for less than 1% of the nearly $725 billion spent annually on long-term care.

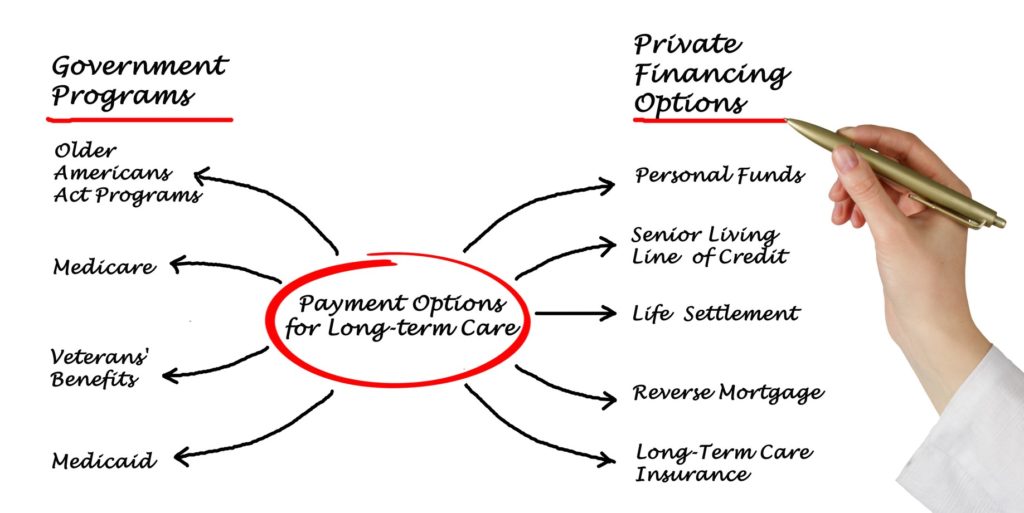

State and federal government programs through Medicare, Medicaid and other government agencies fund about 29%.

Families’ out-of-pocket costs and unpaid expenses fund the remaining 70%.

Why family caregivers face significant risks

- 62% spent savings and retirement funds to pay for care needs

- 77% of those employed missed work

- Missed hours equated to seven per week or 18% of a 40-hour work week

- Average lost income was 33% every year of caregiving

We could go on and on. As baby boomers age, it’s only going to get worse without a plan to fund long-term care expense.

For most Americans there are just three funding options: self-fund, private insurance or government assistance. Read more about funding here.