Years ago, I managed the regional multi-state Medicare business for a large, well known insurer. Frequently, I would hear stories about a person aging into Medicare who had talked to a friend who worked with a guy that knew an expert who told them that Medicare paid for long-term care (LTC).

Still today it’s not unusual for clients to tell me that they don’t need long-term care insurance because they are covered by Medicare.

There remains more than a bit of confusion around this issue fueled by a recent memo from the Centers of Medicare and Medicaid (CMS). More on the memo later.

The confusion that Medicare pays for LTC began decades ago. That’s because prior to 1998 Medicare did pay for long-term care. But when the Balanced Budget Act was passed in 1997 the rules changed.

Once upon a time Medicare paid for long-term care

Medicare is the federal health care insurance program for people age 65 and older or those younger who are totally disabled. It was created in 1965 under the Social Security Act.

Medicare was designed to address curative or rehabilitative care needs. In other words, short-term care that helps us recover or recoup. It was never intended to pay for long-term care which is custodial in design.

LTC provides assistance with activities of daily living defined as bathing, dressing, eating, toileting, continence and transferring. It is care that will be needed for at least 90 days or longer.

Long-term care also provides supervision for those with cognitive impairment which includes numerous forms of dementia including Alzheimer’s.

Medicare has four different components

Medicare Part A is considered hospital insurance. It helps cover the cost of a skilled nursing facility following three nights in a hospital when discharged to a Medicare-approved skilled nursing facility, hospice or housebound and approved for home health care.

Medicare Part B is considered medical insurance and covers medically necessary services like doctors’ fees, lab services and outpatient care. Part B also helps cover some preventive services to help maintain health. This is a voluntary program with premiums, deductibles and co-pays. Usually the Part B monthly premium is deducted from the insured’s Social Security check.

Medicare Part C, also known as Medicare Advantage plans, combines Part A, Part B and sometimes Part D. These plans must cover medically necessary services and can charge different co-payments, coinsurance or deductibles. Medicare Advantage plans are offered through private health systems and may offer more coverage including hearing, vision and dental plans.

Medicare Part D is prescription drug coverage. It helps lower prescription drug costs and helps protect against higher costs in the future. There are several plans offered through private insurance carriers.

Medicare pays for some custodial care

If you rely on Original Medicare and/or a Medicare supplemental policy, read on.

Today, Original Medicare will cover 100% of the first 20 days in a skilled nursing facility, if specific requirements are met. These include but are not limited to:

1) being admitted and hospitalized for three nights,

2) needing skilled care daily,

3) being under a curative or rehabilitative plan of care supervised by a physician and

4) entering the facility within 30 days of being hospitalized and for the same reason as the hospitalization.

The Medicare beneficiary must be admitted to the hospital. “Held for observation” doesn’t trigger Medicare coverage for long-term care.

After the first 20 days, Medicare may cover a portion of the next 80 days. During this time the Medicare beneficiary must pay the daily deductible or coinsurance fee. In 2022, the daily deductible is $194.50. In 2023 it increases to $200.00. Depending on your supplemental plan, this cost may be covered.

Beyond 100 days, Medicare covers very little in the way of custodial care. Recent studies report that on average Medicare pays for about 22 days of long-term care. The limiting requirement is that most beneficiaries do not need skilled care daily longer than about 25 days.

A Medicare supplement policy, also known as a Medigap plan, is private insurance that helps pay for some of the gaps in Medicare coverage. Depending on the defined coverage of a specific Medigap policy it may pick up costs not paid by Medicare, but the costs must be for a service defined by the CMS.

Medigap plans are standardized by the CMS. For example, every insurance carrier that offers Plan G must provide the specific minimum coverage defined by CMS. The primary difference in Medigap plans is the pricing by private companies.

Medicare Advantage plans may offer some LTC services

A recent CMS memo allows insurers offering Medicare Advantage plans to include limited long-term care services as covered benefits. The allowable changes pertain to Medicare Advantage plans only.

In addition to adult day care fees, a Medicare Advantage plan could pay for:

- In-home support services to help people with disabilities or medical conditions perform activities of daily living and instrumental activities of daily living within the home, “to compensate for physical impairments, ameliorate the functional/psychological impact of injuries or health conditions, or reduce avoidable emergency and health care utilization.”

- Short-term respite care or other support services for family caregivers.

- Non-Medicare-covered safety changes, such as installing grab bars, that might help people stay in their homes.

- Non-emergency transportation to health care services. (Plans can already pay for ambulance services for enrollees experiencing medical emergencies.)

Medicaid remains the primary funder of LTC

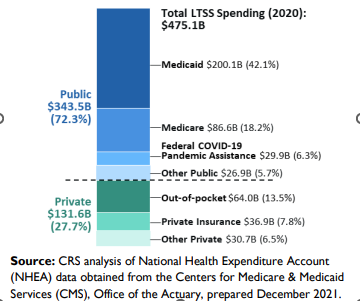

Medicaid is a federal program for low-income, financially needy or totally disabled people. It is set up by the federal government and administered differently in each state. The latest figure show that Medicaid remains the primary funder of LTC expenses at 42.1%.

Medicare covers an additional 18.2% of long-term care expense. Medicare is the federal program that provides hospital and medical insurance to people aged 65 or older and to certain ill or disabled people. A new public funding category is COVID-19 assistance at 6.3%.

Another 5.7% comes from other public funding programs such as Veterans Health Administration and Bureau of Indian Affairs. Together these government programs fund 72.3% of care.

Private funding accounts for 27.7% of long-term care expenses with 13.5% paid from income and saving, 7.8% from private insurance and 6.5% from private sources including philanthropic foundations and corporations.