Closeup portrait of elderly woman looking at the camera.

Yikes! I might be. “Elder Orphan” is a term that is becoming commonplace regarding long-term care and for good reason.

Defined:

The current definition of an elder orphan is an old person who is single, lives alone, and has no children or support system.

Causes:

This happens for a number of reasons. Most of my women friends who along with me climbed the proverbial corporate ladder didn’t have kids. We married older guys increasing our odds of widowhood. Some never married. Others have outlived family and close friends.

Facts and Stats:

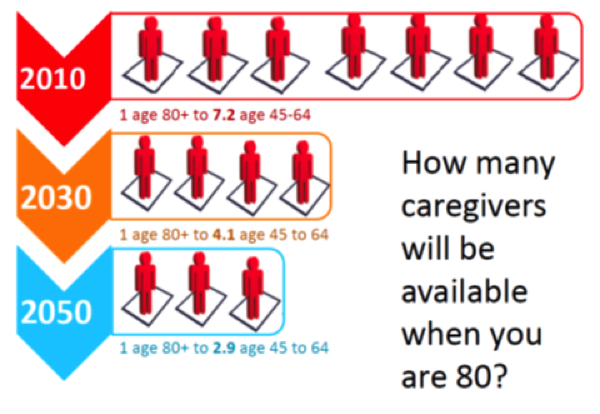

The AARP Public Policy Institute reported that in 2010 there were 7.2 potential caregivers ages 45 to 64 for every person age 80 or older.

Between now and 2030, as baby boomers age and require care, the number of caregivers is projected to drop to 4.1 for every person age 80 or older.

By 2050, it is projected to plummet to 2.9. Bottom line, there is a shrinking pool of family caregivers at the same time that there is a rapidly increasing number of people who will need care.

The University of Michigan’s Health and Retirement Study reported that 22 percent of people over age 65 are either currently or at risk to become elder orphans. This percentage will increase as baby boomer age.

Today, a third of Americans aged 45 to 60 are single. Dr. Maria Torroella Carney, a geriatric and palliative care physician who coined the term elder orphan, explains being isolated, old and alone contributes to physical decline, metal health issues and premature death.

Consider that 60% of nursing home residents do not have visitors.

Elder orphans are not defined by economics. They can be people of means but do not understand how to access things they need or how to advocate for themselves. Who will carry out their end-of-life wishes?

Regardless of how it may come to be, it is essential for all of us to consider what life would be like if we found ourselves orphaned.

Remedies:

- Make a plan! If you think you may be aging solo don’t delay making decisions. While still healthy and lucid figure out your plan. Be sure that critical documents are in place including financial and health care powers of attorney, living will, trust, etc.

- Build a circle of friends and designate a trusted advisor to be your personal advocate if you cannot handle health care or financial decisions.

Who will you entrust to carry out your preferences if you are not able to speak or decide for yourself? Make sure that person(s) is willing to perform this role for you.

Be sure that all of your preferences are known along with the location of your documents.

- Consider your living arrangements. If remaining in your home, do you know your neighbors?

Does your community have a Senior Citizen Call Service like that provided by the Madera County Sheriff’s Office in California? This service places a daily call to elder orphans. If there is no answer after several attempts the sheriff’s office will dispatch someone to check on the resident’s welfare.

Will a retirement community provide the kind of support and social environment important in later years?

- Where do you want to live if you need long-term care? At home? In a continuing care retirement community? Assisted living community?

The government projects that by age 65 and older 70 percent of us are going to need long-term care. How will you pay for this care?

For most Americans there are just three funding options: self-fund, private insurance or qualify for government assistance designed for the indigent.

These questions can help you construct your plan so that if you are alone in later years and need assistance, your preferences are known and can be implemented by someone you trust.

I hope becoming an elder orphan is not in your future or mine. But if it is, making a plan will help us to manage the challenges of aging and provide some peace of mind.